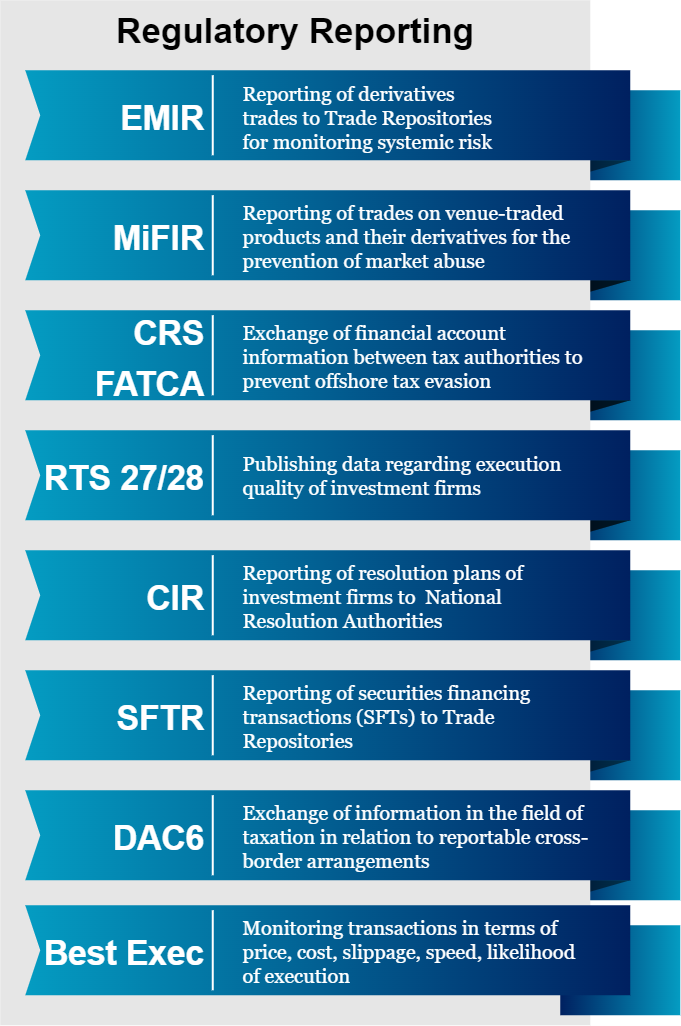

EMIR

The European Market Infrastructure Regulation (EMIR) is an EU legislation which came into effect on August 2012 for the purpose of improving transparency in derivatives markets, mitigating systemic risk and protecting against market abuse.

EMIR requires reporting of the transaction details of exchange-traded and over-the-counter derivatives trades to Trade Repositories that have registered with ESMA. The deadline for reporting the transactions is the next day after each transaction was executed. Additionally, financial counterparties and non-financial counterparties above the clearing threshold are required to report collateral and valuation data for their open positions on a daily basis.

EMIR Refit, also known as “EMIR 2.1”, is the most recent amendment to EMIR and is applicable as of 2020. It brings substantial changes to EMIR including: expanding the definition of Financial Counterparties (FCs) to include AIFs, introducing the notion of Small FCs which are exempt from the clearing obligation, and making FCs responsible for submitting transaction reports on behalf of their clients that are Non-FCs below the clearing threshold.

MiFIR

The Markets in Financial Instruments Regulation (MiFIR) is an EU legislation aiming to strengthen the transparency and improve the functioning of the internal market for financial instruments.

MiFIR transaction reporting applies to investment firms in the European Economic Area which have the obligation to report transaction details to National Competent Authorities (NCAs) as quickly as possible, and no later than the next working day after the transaction was executed. The obligation applies to financial instruments which are admitted to trading or traded on a trading venue or their underlying financial instrument is traded on a trading venue.

CRS

The Common Reporting Standard (CRS) is a global standard for the automatic exchange of financial account information, developed by the Organisation for Economic Cooperation and Development (OECD).

CRS is designed to prevent offshore tax evasion. It gives participating countries transparency on the financial assets held offshore by their residents. CRS requires financial institutions to identify customer tax residencies and report financial accounts held directly or indirectly by foreign tax residents to local tax authorities, and subsequently the tax authorities in each participating country exchange with each other.

FATCA

The Foreign Account Tax Compliance Act (FATCA) is a U.S. law aiming to stop tax evasion from U.S. citizens that may be concealing assets held in foreign accounts.

FATCA requires foreign financial institutions and certain other non-financial foreign entities to report the identities of U.S. citizens and the value of the assets held in their accounts. Foreign financial institutions that do not comply with FATCA reporting will be excluded from the U.S. market and also have 30% of the amount of any withholdable payment deducted and withheld from them as a tax penalty.

RTS 27/28

RTS 27 and RTS 28 reports are defined as part of Article 27 of the MiFID II Regulation. The aim of the reports is to ensure that financial firms monitor, and subsequently make publicly available, execution quality and order routing.

Commission Delegated Regulation (EU) 2017/575 sets the regulatory technical standards of RTS 27 concerning the data to be published on the quality of execution of transactions. RTS 27 is a quarterly report, applicable to trading venues, systematic internalisers, market makers, and other liquidity providers.

Commission Delegated Regulation (EU) 2017/576 defines RTS 28’s regulatory technical standards, for the information on the identity of execution venues and on the quality of execution. RTS 28 is published annually by investment firms.

CIR

Commission Implementing Regulation (EU) 2018/1624 (CIR) lays down implementing technical standards specifying procedures and a minimum set of standard templates for the submission to resolution authorities of information necessary to draw up and implement individual resolution plans, in accordance with Article 11 of Directive 2014/59/EU (BRRD), and group resolution plans in accordance with Article 13 of that Directive.

Investment firms are required to submit their resolution planning forms to their National Resolution Authority. Part of the templates must be submitted in XBRL format and must comply with the EBA 2.10 XBRL taxonomy published on European Banking Authority’s (EBA) website.

SFTR

Securities Financing Transactions Regulation (SFTR) refers to transactions that are related to, inter alia, the build-up of leverage, pro-cyclicality, liquidity and maturity transformation, and interconnectedness in the financial markets, as set out in Regulation (EU) 2015/2365 of the European Parliament and of the Council of 25 November 2015 on transparency of securities financing transactions and of reuse and amending Regulation (EU) No 648/2012.

SFTs include: a repurchase transaction; securities or commodities lending and securities or commodities borrowing; a buy-sell back transaction or sell-buy back transaction; a margin lending transaction.

DAC6

Council Directive (EU) 2018/822 amends Directive 2011/16/EU, known as DAC6, as regards mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements, aiming to eliminate aggressive tax avoidance tactics.

Under this regulation, intermediaries or taxpayers are obliged to report cross-border tax arrangements to tax authorities if they meet the specified criteria and at least one of the involved countries is an EU member state. The local tax authorities subsequently share this information which is submitted in XML format, with the relevant EU countries.

Best Exec

Article 27 of MiFID II mandates that investment firms take all sufficient steps to obtain, when executing orders, the best possible result for their clients, taking into account price, costs, speed, likelihood of execution and settlement, size, nature or any other consideration relevant to the execution of the order.

Investment firms use Best Execution reports to demonstrate to their clients, at their request, that they have executed their orders in accordance with the investment firm’s execution policy and to demonstrate to the Competent Authority, at its request, their compliance with Article 27 of MiFID II.